Start Your Financial Journey

Financial Literacy Program

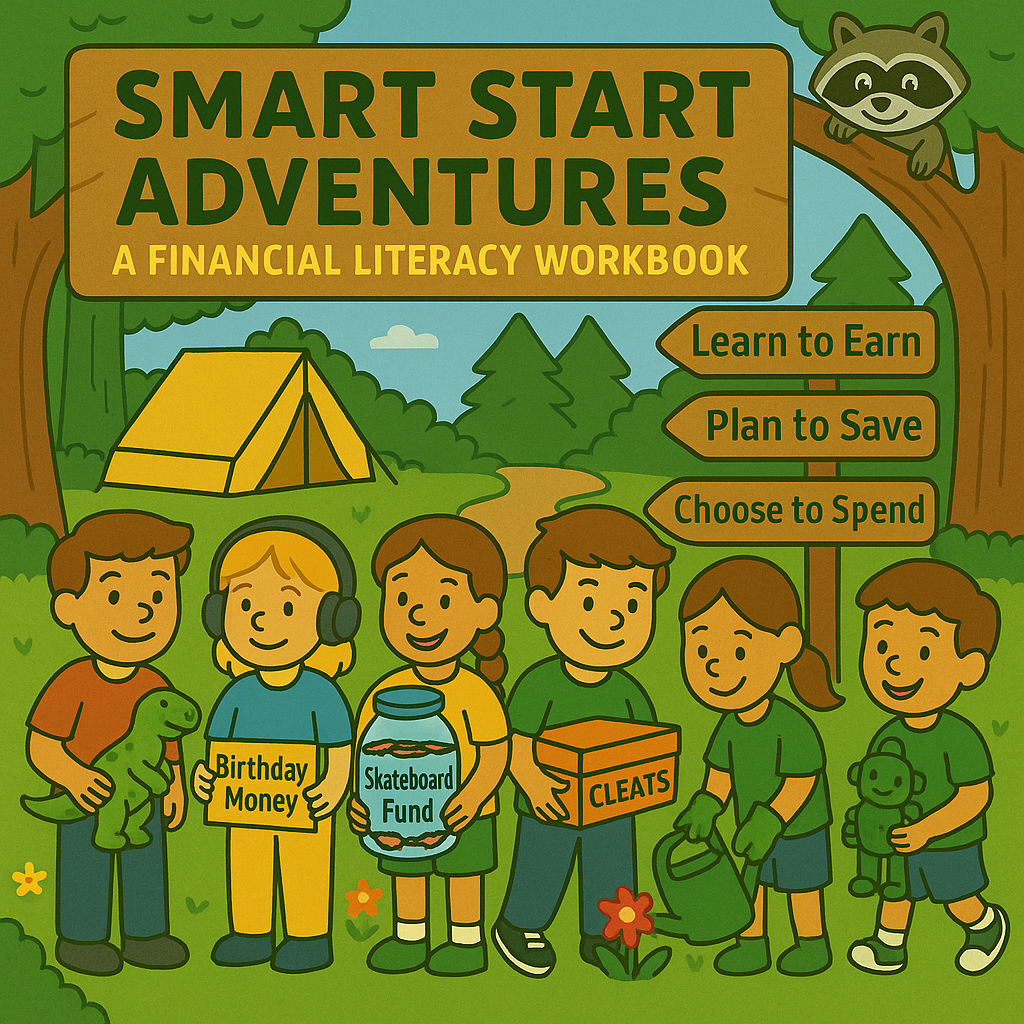

Smart Start Adventures is a fun, hands-on financial literacy program designed just for third graders. Over six weekly lessons, students explore what money is, how it’s earned, the difference between needs and wants, the importance of saving, and how to make smart spending choices. The program includes a real-world simulation where students earn classroom “paychecks,” make savings decisions, and track progress toward personal goals, all tied to a real savings account at Journey Federal Credit Union. Through storytelling, interactive activities, and real-life rewards, students gain practical money skills they can carry into the future.

Program Materials

- Overview and Welcome Letter (PDF)

- A warm introduction to the program, goals, structure, and outcomes

- Standards Alignment Summary (PDF)

- Official mapping to Jump$tart and Common Core, plus Jump$tart Clearinghouse Listing intent

- Scope and Sequence (PDF)

- Week-by-week breakdown of lessons, topics, and learning outcomes

- Student Workbook (PDF)

- Printable workbook with story-based lessons and interactive activities

- Teacher Manual (PDF)

- Fully scripted lessons, discussion prompts, timing, and vocabulary

- Answer Guide for Teachers (PDF)

- Suggested responses to workbook activities and discussion prompts

- Pre/Post Explorer Comprehension Quiz (PDF)

- Assessment to track student learning and celebrate growth

- Parent Letter Template (PDF)

- Explains the program and encourages at-home participation

- Certificate of Completion (PDF)

- Celebrates and recognizes adventurers who have completed Smart Start Adventures